Bitcoin's peak predictions

Analyzing Bitcoin’s Historical Peaks and Projecting Future Prices

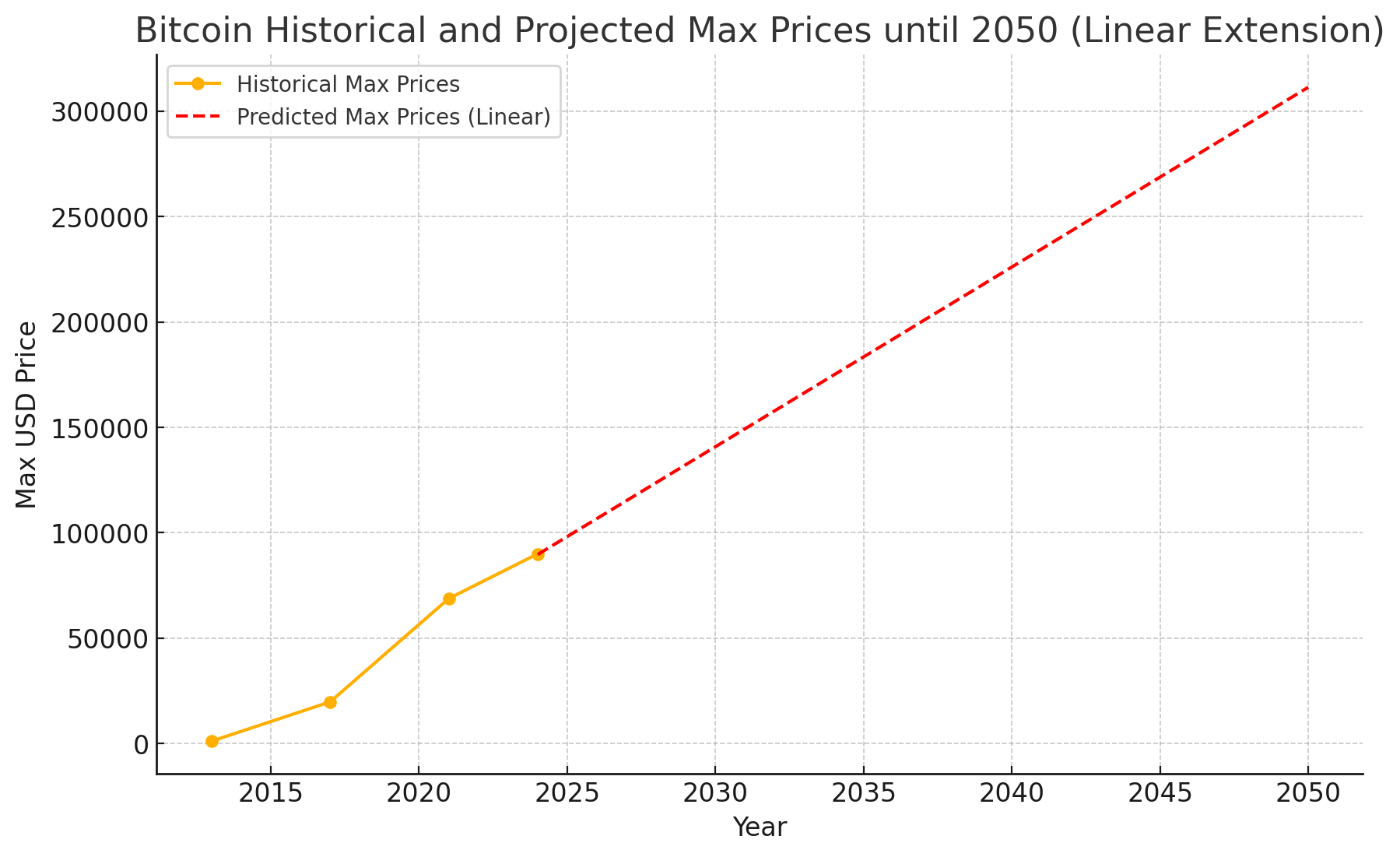

Bitcoin, the pioneer cryptocurrency, has shown remarkable growth since its inception, with its price often reaching new heights during its market cycles. In this analysis, we focus on Bitcoin’s major all-time highs (ATH) and investigate whether its peak prices follow a discernible pattern. Using a linear trend derived from the most prominent peaks, we project Bitcoin’s future prices up to 2050.

This analysis is meant as a demonstration of the kind of work you can guide ChatGPT to do. I proceeded in steps, exploring data, making hypothesis, asking for clarifications etc and lastly asked ChatGPT to rewrite our discussion into a blog post explaining the conclusion we reached. This is absolutely not meant as financial advice!

Historical Peaks: Key Data Points

Bitcoin’s major ATHs reflect its adoption curve and the influence of market cycles. Here is a table of Bitcoin’s most significant peaks:

| Year | Max USD Price |

|---|---|

| 2013 | $1,151 |

| 2017 | $19,783 |

| 2021 | $68,789 |

| 2024 | $90,000 |

These peaks correspond to critical moments in Bitcoin’s history, often driven by increased adoption, halving events, and heightened market interest.

Observing a Linear Trend

When focusing on these major peaks, we observe a roughly linear progression in Bitcoin’s maximum prices over time. While cryptocurrency markets are known for their volatility, these selected peaks suggest that Bitcoin’s growth can be modeled linearly for long-term projections.

Graph: Historical and Projected Bitcoin Prices

Below is a plot of Bitcoin’s historical peaks (2013, 2017, 2021, 2024) along with a linear extension to 2050:

Linear Projection Methodology

We used a simple linear regression model based on the four historical peaks listed above. The model predicts future prices assuming Bitcoin continues to follow a similar trajectory:

- 2030: ~$150,000

- 2040: ~$300,000

- 2050: ~$450,000

While these projections should not be taken as guarantees, they provide a plausible trendline based on past growth.

Implications of a Linear Trend

This analysis suggests that Bitcoin’s maximum price growth could continue to exhibit a steady upward trajectory, provided that its adoption and utility grow alongside market demand. However, this trend is subject to various macroeconomic factors, regulatory changes, and technological advancements.

Conclusion

Bitcoin’s historical price movements offer valuable insights into its market cycles. While we cannot predict future prices with certainty, analyzing past peaks provides a framework for understanding long-term trends. This linear projection serves as a starting point for discussing Bitcoin’s potential future in the evolving financial landscape.